Amazon's Future: Not Just a Retailer, But a Booming Ad and Commission Platform

Amazon is rapidly transitioning to an ad-focused platform, with ad revenue set to surpass AWS by 2026. As ads and fees grow, sellers face shrinking margins.

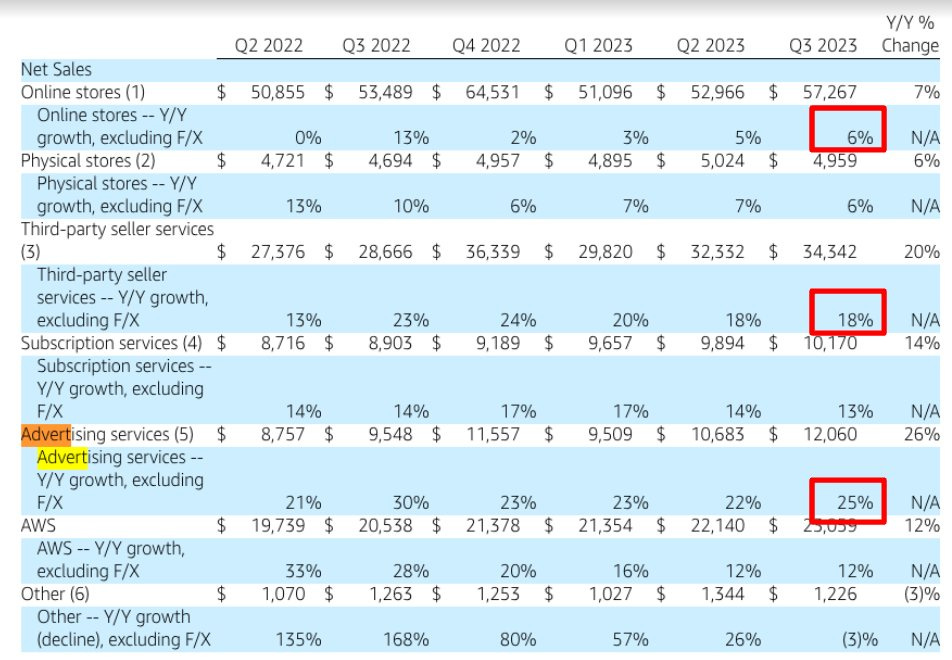

If you're an Amazon seller or just a curious observer of this e-commerce giant, the recent earnings report shared some pivotal numbers that you should be paying attention to.

Amazon's Future: Not Just a Retailer, But a Booming Ad and Commission Platform

Amazon is rapidly transitioning to an ad-focused platform, with ad revenue set to surpass AWS by 2026. As ads and fees grow, sellers face shrinking margins.

1. Amazon's Shift to Third-Party Sellers Over the years, Amazon's emphasis on third-party (3P) sellers has been on the rise. This trend hasn't slowed down; in fact, it's accelerating.

2. The Meteoric Rise of Ad Revenue Amazon's ad revenue segment is not just growing; it's skyrocketing. It's the fastest-growing revenue segment for the company, surpassing even their subscription services like Prime, Amazon Music, Twitch subs, and Audible.

To put it into perspective, the revenue from ads is already half as much as Amazon Web Services (AWS), and its growth rate is double. If this growth keeps its pace, by 2026, ad revenue will overtake AWS.

3. Third-Party Seller Fees: The Silent Giant Another intriguing statistic is the revenue from third-party seller fees. It's not just substantial; it's huge. It's 50% larger than AWS and is growing at a rate that's 50% faster.

The Real Amazon Despite the common perception, Amazon isn't merely a retailer or just the powerhouse behind AWS. The company is rapidly evolving into a major ad platform, a Third-Party Logistics (3PL) provider, and a platform that earns commissions from every sale. These segments are not only the fastest growing but also the most profitable for Amazon.

The Implications for Sellers While AWS faces challenges in growing due to intense competition and its commodity nature, the ad segment has an advantage. The Amazon marketplace is a captive audience. If Amazon wants to achieve, say, a 15% growth, they might opt to increase the cost per click.

The foreseeable future of Amazon is clear: more ads and increased fees. But what does this mean for sellers? Well, the margins are set to become even slimmer.

The Critical $12 Net Profit per Unit For sellers to thrive and not just survive in this evolving landscape, having a net profit margin of more than $12 per unit will be crucial. Why? The rising costs related to advertising and fees will eat into profits. A significant net profit ensures that you can cover these expenses and still maintain a healthy margin. Obviously this is a minimum I recommend to my clients. The higher the better!

Part of this strategy was outlined in this recent post about Prime day sales and the strategy we used to double the sales of one of our brands

Behind the Scenes of Prime Big Deal Days: Insights and Takeaways for Sellers

Amazon's Prime Big Deal Days made history on October 10th and 11th, becoming the biggest October sales event ever held. During these days, Prime members enjoyed massive savings, totaling over $1 billion on a myriad of products. Designed exclusively for Prime membe…

Let’s not forget, with new Sponsored Brand TV ads coming out of BETA soon, this will certainly be the means in which Amazon shifts from data platform, to advertising engine.

Amazon launching Sponsored TV ads

In a move that showcases Amazon's relentless pursuit of innovation, the e-commerce behemoth is unveiling its latest advertising avenue - Sponsored TV ads. A step beyond traditional advertising mediums, this new feature aims to seamlessly blend commerce and entertainment.

Conclusion As we head into 2024 and the years beyond approach, Amazon sellers need to adapt to these shifts. Increasing your net profit, diversifying your advertising strategy, and ensuring product quality will be more vital than ever. How will you navigate these changes?